When it comes to tech trends for this year and into 2024, generative AI is clearly creating more buzz than any other technology trend. It’s been the darling of investors, executives, and the media, who can’t pass up a good story about students cheating on assignments and machine-generated inflated resumes.

Despite a mid-year (and inevitable) swoon in visitors to the ChatGPT site, artificial intelligence – and generative AI in particular – figure to remain a popular and growing area of tech in B2B circles into 2024 and beyond.

But AI and generative AI are likely to make inroads into businesses through software the organization is already using or when businesses adopt new software in an existing category (like CRM, for example) that bakes AI into its product. In other words, many businesses won’t spend money on AI per se, but will gain AI capabilities through their existing tech spending.

Speaking of tech spending by businesses, analysts expect it will grow significantly in 2024. Overall, Gartner expects worldwide IT spending to grow 8.8 percent in 2024, which is almost double the firm’s 2023 expectation of 4.3 percent growth.

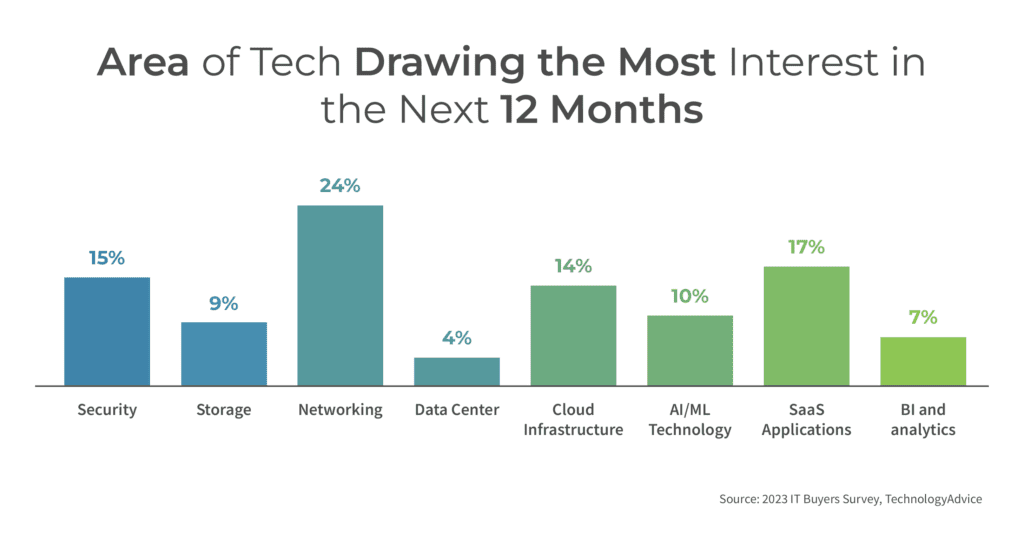

The 2023 IT Buyers Survey from TechnologyAdvice asked business technology buyers which areas of tech would be drawing the most interest from their organizations over the next 12 months. About 10 percent of the respondents cited artificial intelligence and machine learning, which puts AI and ML above business intelligence and analytics, storage, and data center tech.

But the tech trends receiving the most interest from buyers in the survey tell a much larger story about the direction of B2B tech and business in general today.

Connectivity is King

Nearly one-quarter of the survey respondents identified networking as the area drawing the most interest in their organization over the next 12 months. In a tech world talking about AI and language models, where SaaS unicorns draw a lot of attention, networking seems decidedly… uninteresting. But there’s more to the story. The future of network technology goes well beyond connecting today’s global, geographically dispersed workforces. And it’s some of the application of connectivity that don’t get a lot of attention that will make it a tech trend to watch in 2024.

When EnterpriseNetworkingPlanet, one of the owned and operated TechnologyAdvice websites, published its list of the top five networking trends for 2023 and beyond, it included:

- SD-WAN technology

- The Internet of Things (IoT)

- Digital twins for better network planning

- AI-based network management

- Next-generation connectivity

Advanced and next-generation connectivity also found a spot on McKinsey’s list of the top tech trends of 2023. These technologies include wireless low-power networks, 5G/6G cellular, Wi-Fi 6 and 7, low-earth satellites, and more. Cloud and edge computing also made the McKinsey list.

Start connecting the dots. These technologies enable faster, more reliable networks and they add connectivity in areas that traditionally were difficult to connect (oil platforms, expansive warehouses, etc.).

What you start to see is a picture emerging of networks and connections that expand far beyond the office campus and remote work offices, and into the field, as witnessed by the inclusion of the IoT on the EnterpriseNetworkingPlanet list.

Supply chains, which were severely disrupted during and after the height of the COVID pandemic, are being connected from end to end. Sensors on equipment, vehicles, and machinery are being connected. Look at your car, your home, and even your appliances. Everything, it seems, is being connected.

Cloud and SaaS Draw Interest

These far-flung networks will deliver data that is processed in the cloud or at the edge and delivered to users in cloud-based software-as-a-service (SaaS) applications. These two areas of technology are als on the radar of business technology buyers. SaaS applications were cited by 17 percent of the IT Buyers Survey respondents, while cloud infrastructure was cited by 14 percent.

Public cloud is expected to remain the main beneficiary of the need for on-demand computing power. Dominated by Microsoft Azure, Google Cloud, and Amazon Web Services (AWS), public cloud computing continues to see impressive growth. Gartner expects public cloud service end user spending to grow 21.7 percent in 2023 to barely $6 billion, up from $491 billion in 2022.

Networks are connecting it all, so it’s really not especially surprising to them attracting so much interest from business technology buyers. There’s also evidence that network-related purchases are attracting attention within organizations beyond the usual network and engineering titles. According to first-party data from TechnologyAdvice, more than 12,000 unique job titles responded to lead generation programs targeting networking buyers in 2022.

And, Of Course, Security

With networks extending to places far from the main office, and edge devices processing data just about anywhere, the missing ingredient is security. All of the data and devices in the various scenarios for IoT, edge computing, and the cloud need to be secured.

Fifteen percent of the buyers who responded to the 2023 IT Buyers Survey said security was the area of tech that would draw the most interest from their organization in the next 12 months.

Some of the security investment dished out will undoubtedly go to securing the networks being built to handle the massive amounts of data being shipped around the world. According to Canalys, network security spending will increase more than 5 percent annually, growing from $21.5 billion in 2023 to $26 billion in 2027.

Putting it All Together

The biggest laggards in the IT Buyers Survey data were data storage and data centers. This is hardly surprising because the era of public clouds, edge devices, and SaaS applications connected by secure, next-generation networks has few opportunities for on-premise data centers and the data storage that resides there.

That’s not to say there is no future for storage and data center tech. There will always be a need for on-premise infrastructure and storage, but its future is increasingly composed of niche applications.

What does this mean for B2B marketers?

The tech vendors and marketing teams that can weave a story for customers and prospects that places their products and services in the ecosystem of secure connectivity will have a powerful message to share. It’s a message that aligns well with where tech buyers and their organizations are headed. It paints your brand as a p[art of the future.