Of the many changes to hit the B2B sector in the past 20 years, none has had the impact of buyers taking control over the process. Today’s buyers are free to seek out information about vendors and products from any number of sources of information.

In the past, vendors held all of the information and they were often reluctant to part with it. Want to see pricing details? Reach out to sales. Want to better understand features and capabilities? Contact sales. Want to see the details on integrations? Our sales team can help.

This became a point of friction for B2B buyers whose online B2C experiences were increasingly focused on the customer experience. Want to read reviews? Click here. Want to see the colors available? Here you go. Want to see the accessories most people buy with this product? Here they are.

Legacy B2B tech vendors were (and many still are) heavily invested in their sales team. And the sales team and its leaders hold a lot of power. So how do they reconcile the buyers’ ideal experience with the sales-led experience they relied on for years? For some, it remains a struggle to this day.

Another significant change in the B2B sector is its sheer size. Potential buyers have, at the very least, dozens of vendors to research and choose from in almost every category. That makes for a very complicated research phase, where different members of the buying committee are learning about new vendors and their products, reading different pieces of content, and starting to draw conclusions.

Because of the time required for these early research-phase activities, vendors that force prospects to initiate a conversation with sales put themselves at a disadvantage. Many prospective buyers aren’t ready to have a conversation. It slows down the process and often leads to follow-up inquiries that have to be managed.

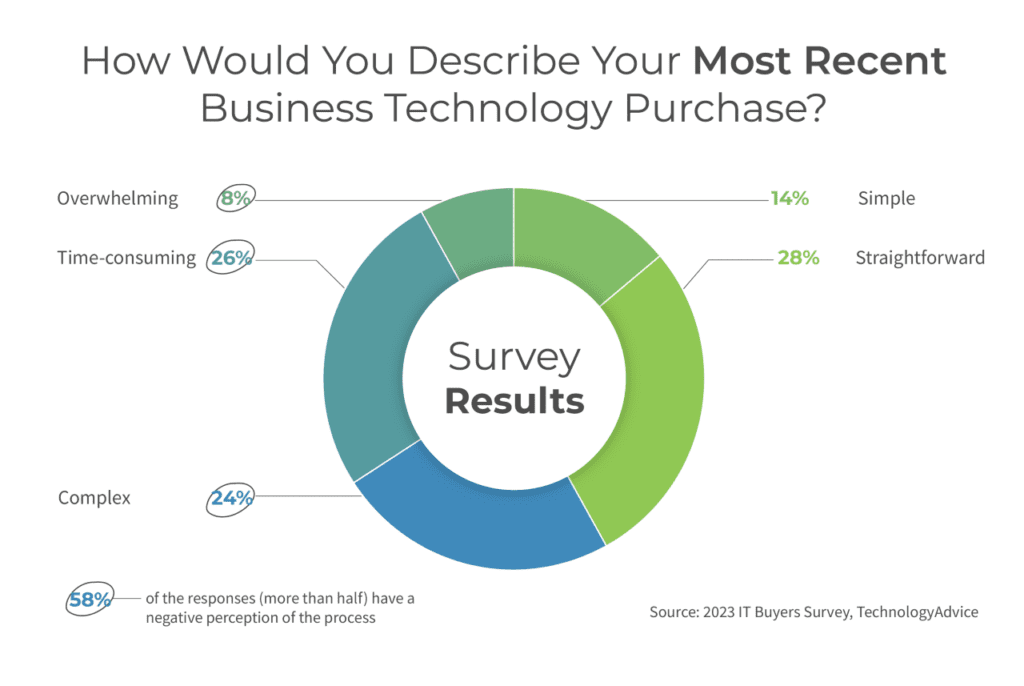

For its 2023 IT Buyers Survey, TechnologyAdvice asked 203 B2B software buyers to consider their most recent B2B purchase when answering questions. These five charts demonstrate what these B2B buyers want from the purchase process.

RELATED ARTICLE: In 3 Charts: Where B2B Buyers Research Vendors and Products

How Buyers View the B2B Purchase Process

Nearly 60 percent of the business technology buyers responding to the 2023 IT Buyers Survey had a negative perception of their most recent purchase process. This includes responses that describe the process as “time consuming” (26 percent of respondents), “complex” (24 percent), and “overwhelming” (8 percent).

For the majority of survey respondents, purchasing business technology is a chore. There’s a lot of information to sift through, a lot of sources of information, and almost always collaboration with other members of the buying team involved.

Which Information Sources Influence B2B Buyers?

As previously mentioned, there are a number of information sources B2B buyers can use to help conduct their product research. Evaluating products and vendors means finding information, consuming that information, then reconciling what one member of the buying committee learns with the information other committee members are bringing to the table.

The 2023 IT Buyers Survey asked B2B buyers to identify the sources of information they consulted in their most recent business technology purchase. The buyers were then asked to rate the influence of each source of information when it come to their eventual purchase decision.

Here is a look at the weighted averages:

Let’s go backward and look at the right side of the image first.

Vendor-created content and sales interactions have the least amount of influence over purchase decisions, according to the survey. As buyers exercise the control they have over the B2B purchase process, they are relying on information from vendors. In fact, vendor content and sales interactions were used by 30 percent of the buyers surveyed, which is tied with third-party sources of information for the most consulted source of information. But the difference in the influence each os those sources carry is substantial.

Vendor content and sales interactions carry less influence than social media and other professional networks, which is surprising because social media traditionally gets low ratings for the trustworthiness of its content.

Third-party sources of information are widely available to B2B prospects and are understood to be reasonably useful and objective. These sources have a level of trust with buyers.

But where trust is readily apparent is with the most influential source of information: brand familiarity.

Trusted, familiar brands give buyers a shortcut through the complex, time-consuming, and overwhelming B2B purchase process. Instead of researching dozens of tools, they go with what they know.

Building brand familiarity and trust is crucial to success in B2B tech. Brand trust takes time to build, and it’s done by putting your brand in front of buyers before they’re in buying mode. That investment then pays off when they’re looking for a solution and remember your brand.

B2B Buyers Want to Move Quickly

Faced with a B2B buying process that more than a quarter of respondents identify as “time consuming,” B2B buyers turn to familiar brands when it’s time to research vendors.

By opting to rely on familiar brands, B2B buyers are looking for two things: trust (e.g., a track record of success) and time savings.

Three quarters of the respondents to the 2023 IT Buyers Survey said they completed the purchase process in 120 days or less. Larger, more complicated business technology purchases will always take longer, but buyers are moving quickly when they can.

More than half of respondents completed their most recent business technology purchase in 90 days or less.

What Have We Seen So Far?

Most business technology buyers want a simpler, faster process. They’re using familiar brands to help them move quickly, and it seems to be paying off.

There are other ways that B2B buyers are trying to simplify the B2B purchase process as well.

Smaller Buying Committees Speed Things Up

If you’ve ever tried to organize your co-workers around, for example, ordering lunch, you know how hard it usi to get people to agree. A similar problem plagues B2B tech purchases, where a buying committee is dealing with a number of choices, overwhelming and sometimes conflicting information, and the risk inherent in making the wrong decision.

With the caveat that larger purchases will often require involvement from more people, respondents to the 2023 IT Buyers Survey said they are keeping their buying committees on the small side.

More than half of the respondents were able to keep the buying committee to three people or less, while only 14 percent said their buying committee surpassed 10 members.

B2B Buyers Are Researching Relatively Few Vendors

There are, as previously stated, dozens of vendors for buyers to consider when they’re researching a purchase. But if a buyer wants to simplify the process and move quickly, there’s one more tactic they can use: reduce the number of vendors you explore.

We’ve already seen that buyers are relying on familiar brands to help them make their purchase decisions easier. And it bears out when you look at the data when buyers were asked about the number of vendors they considered at each stage of the B2B buying process.

Once buyers get beyond the initial research phase of the process, relatively few vendors are considered. This too helps speed up and simplify the process, as the later stages will take up the most time in most cases.

Conclusion: B2B Buyers Want an Easier Process

Fewer vendors, fewer people, fast decisions, and familiar brands help B2B Buyers reduce the complexity of the buying process.

What does this mean for B2B marketers?

- Build brand familiarity and trust early, before prospects are in market.

- Educate, inform, and deliver value to prospects before they’re ready to buy.

- Put your brand where your buyers are. Third-party sources of information ranked highly among buyers for their use and influence.

- Develop a buyer-friendly customer experience. Make it easy for buyers to find and consume the information they need.