Nearly 20 years ago, I started my first Performance Marketing business, Thrive Marketing Group. It was an opportunity to harness my passions for entrepreneurship, web technologies, and the rise of digital marketing. But most of all, it was an opportunity to have a profound impact on the success of our clients, helping them grow their businesses faster by leveraging the unique knowledge and skills we offered.

It wasn’t just about lead generation; It was about driving their business forward and being a partner they could count on to accelerate growth. To live up to that responsibility, we had to be innovative, collaborative, transparent, and trustworthy.

As we transformed that business into TechnologyAdvice nearly 10 years later, those values and commitments remained. We expanded our investments in our global tech media sites, 1st-party audience development, and world-class editorial, SEO, customer success, and technology teams. While these were costly endeavors, we knew they would be critical pieces to driving the success of our clients for years to come. Not just to help them generate more leads, but to capture real demand and drive revenue.

Over the last decade, I’ve seen the lead generation market grow and adapt to new buyer trends and new technologies. I’m proud to say that we’ve grown and adapted with it—all while remaining committed to innovation, collaboration, transparency, and being a trusted partner our clients can count on.

Unfortunately, we haven’t seen the same commitments from other lead generation providers in the market, despite how they may position themselves in their marketing materials. We’ve seen long-standing vendors take shortcuts and make claims they can’t back. We’ve seen new database marketing entrants who value low-cost execution and high-pressure sales tactics over quality, trust, and client success.

Due to a lack of transparency, it’s often hard to know which vendors are truly focused on the best outcomes for their clients and which ones are simply buying and selling lead data to turn a profit.

As someone who is passionate about this space and who cares deeply about connecting the right in-market B2B buyers with the world’s leading sellers of business technology, I felt it was important to share the information below on some trends I’m seeing in the content syndication and lead generation markets.

My goal is to give you an understanding of what’s happening behind the scenes and to arm you with the tough questions to ask when evaluating new lead gen providers. I hope you’ll walk away feeling better equipped to make well-informed decisions about who to partner with and how to allocate your resources to generate the best outcomes for your business.

Let’s dive in.

Table of contents

- Lead generation wasn’t always so complicated

- 3 key trends with content syndication and lead generation companies

- How to determine if a lead generation partner is right for you

- Questions to ask before hiring a lead generation company

Lead generation wasn’t always so complicated

Believe it or not, lead generation used to be pretty straightforward.

You had a product you wanted to drive demand for, so you’d buy clicks from Google and leads from publishing partners. Sometimes you’d be able to define targeting criteria like company size, geography, industry, and job title. The tactics for generating new leads were transparent and well-understood.

If you were buying clicks from Google and driving traffic to a landing page, you’d see what topics users were searching for. You’d know where they were located and what other activities they performed on your website.

Using these reliable insights, you could engage prospects on an individualized basis—offering the next best piece of content, steering them towards the right offer, or initiating sales engagement. You could easily repeat this process and scale your B2B lead generation efforts. Easy peasy, right?

Unfortunately, there are only so many buyers in-market for a solution like yours at any given time, and only a fraction are clicking on your ads to learn more. So what do you do to drive more sales opportunities?

There are plenty of other viable options including virtual and in-person events, digital advertising on trusted media sites, referral and advocacy programs, and the new king of marketing strategies: content marketing.

RELATED ARTICLE: 4 Mistakes to Avoid When Hiring a B2B Lead Generation Company

The rise of content marketing

Content marketing is a scalable way to build brand and generate demand from potential buyers in your ideal customer profile (ICP). Great content can fuel inbound traffic to your website and help capture in-market demand. It can also be used in content syndication programs to expand brand awareness and generate leads through 3rd party distribution channels.

Content syndication dates back to the early days of newspapers when publishers saw the value of sharing content with other publications to amplify their message. As technology advanced, the internet emerged as a game-changer, providing a platform for the seamless distribution of digital content at scale.

In B2B marketing, content syndication gained traction as companies began sharing influential thought leadership. By partnering with industry-specific websites, newsletters, and online publications, you could get one piece of impactful content in front of thousands of potential buyers on trusted digital channels. This has proven to be a valuable way to grow brand awareness with new audiences while generating opt-in leads from companies looking for a solution like yours.

Believe it or not, the B2B content syndication market was built on trust, transparency, and value exchange.

Audiences received valuable content from publishers with whom they had a longstanding relationship. They trusted them to handle their personal information responsibly and serve them with the right content at the right time. Publishers took these relationships very seriously, understanding that a breach of trust would lead to a decline in engagement. They maintained high standards for quality and transparency, ensuring their vendor partners clearly understood where their content was being syndicated, who engaged with it on which channels, and how consent was managed.

In this value-based ecosystem, content syndication was valuable for all stakeholders. Vendors were able to reach the right B2B professionals, audience members were learning about relevant topics and solutions, and the publishers brought the two together.

And that brings us to today.

RELATED ARTICLE: 10 Questions To Ask A Lead Generation Company During Your First Meeting

The fall of content syndication

When most marketers think about content syndication today, they don’t think of this value-based ecosystem. Instead, they think of transactions, lead data, high volumes at low cost, and an experience that often feels empty and confusing.

They think of it as a transactional lead marketplace rather than a strategic value-based ecosystem—and the implications of this are significant and concerning.

So how did we get here?

And how can marketers and business leaders who want to leverage the power of content syndication figure out if a publisher or lead generation provider is creating real demand via an engaged audience or just sending out email blasts until they hit their lead commitments?

Let’s explore some recent trends at play and what questions to ask to better understand the true nature of potential lead generation partners.

3 key trends with content syndication and lead generation companies

1. Publishers with owned audiences vs. database marketers

✅ Publishers with owned audiences

One of the hallmarks of high-value content syndication is the ability for publishers to reach, engage, and influence audiences in a reliable and trustworthy way. Those with established brands and long-standing followers are uniquely positioned to do so.

For example: Every month, hundreds of thousands of B2B professionals frequent media sites like TechRepublic, eWeek, Datamation, DZone, and eSecurity Planet which are all owned and operated by TechnologyAdvice. They also subscribe to newsletters published by these brands, and even phone in to speak with experts about their technology needs. TechnologyAdvice (TA) invests in large editorial teams and subject matter experts who build trusted relationships with audiences over time.

Publishers like TA have built up owned audiences through long-term investments in thought leadership and editorial strategies. They’ve collected 1st-party data and, in many cases, have accrued a significant amount of information about individuals and accounts over months or even years.

These owned audiences provide publishers with many advantages, including:

- Exclusive insights on individual engagement patterns and topics of interest

- Visibility into the research trends and current priorities of different companies

- Verified contact details for audience members

- Reliable channels to reach and influence audience members over time

- Ability to engage various stakeholders from the same company over time and across multiple channels and formats

❌ List aggregators and database marketing

Many newer B2B lead generation companies are cutting corners by aggregating audience data from other publishers or creating contact lists using 3rd party data. They then send email blasts and make phone calls to these contacts. This is known as database marketing.

While these vendors offer a seemingly “easy” and low-cost solution for content syndication or lead generation, they’re often pushing your messages out to a cold, disengaged audience via one-off eBlasts. They’re simply playing a numbers game, getting a low percentage conversion rate on a high volume of outbound messages—and sometimes bundling multiple content assets together to hit lead goals for multiple vendors at once.

This is problematic for several reasons. Typically, there is:

- No trust factor with their brand

- No ability to engage individuals with multi-touch campaigns across different channels

- Limited brand recall by recipients following the campaign

- Limited ability to truly influence buying behavior

Using these vendors can also create a brand safety risk to your organization, as recipients may receive unsolicited emails or calls encouraging them to download your content, even though it may not be timely or relevant. These programs can often do more harm than good, giving potential prospects a poor experience with your brand.

Leads shared by content syndication providers who are leveraging aggregated lists and performing database marketing typically convert into revenue at a much lower rate and do little to support brand building, pipeline generation, or account-based marketing goals.

❌ Offshore lead manufacturing farms and lead marketplaces

Platforms like LinkedIn and ZoomInfo have democratized contact information, leading to a rise of lead generation providers that differ from high-value publishers and demand gen partners, despite similar messaging.

Offshore lead manufacturing farms have become commonplace as low-cost services for acquiring verified contact information, known as Contact Discovery Quality Assurance (CDQA). This service validates business professionals’ details, including email addresses, phone numbers, social media profile links, and mailing addresses. While useful, this data is often sold using high-pressure sales tactics and misrepresented as “qualified leads.”

Lead generation providers and marketplaces without 1st-party audiences frequently buy this information, running database marketing campaigns to cold contact lists without express opt-in permission to generate leads for their customers. Unfortunately, the ease of entry and lack of consequences for misrepresenting lead data have allowed these poor practices to spread. Many new providers rely on aggregated lists and manufactured demand data instead of building owned audiences and capturing in-market demand.

2. Providers who capture in-market demand vs. manufacturers of demand data

✅ Capturing demand from in-market accounts

While we all wish we could sell to any company in our ICP, less than 5% of your target buyers are in-market for a new solution at any given time. Efficient marketing and sales programs focus on identifying these in-market accounts and capturing existing demand, rather than trying to manufacture new demand from out-of-market leads.

Publishers with owned audiences excel at this, using exclusive 1st-party buying signals and direct feedback – such as engagement in product comparison pages, answers to survey questions or information collected on live phone calls – to pinpoint in-market accounts. They prioritize generating sales opportunities over merely hitting lead volume thresholds.

In addition to capturing demand via bottom-of-funnel (BOFU) buying signals, publishers who also post top-of-funnel (TOFU) and middle-of-funnel (MOFU) content can identify the next 5% of in-market buyers based on engagement patterns. Using these insights, they can help customers run brand-building programs with this audience of next-in-line buyers to further aid demand capture in the following months.

Publishers like TechnologyAdvice offer brand-to-demand services that capture demand from in-market accounts while building brand with next-in-line accounts for perpetual pipeline development.

❌ Demand data manufacturing

Many content syndication providers are not focused on revenue outcomes and are willing to cut corners on what they consider to be a qualified lead or an in-market account. Because it’s more costly and resource-intensive to identify and engage those 5% of in-market accounts, they’ll often focus on manufacturing demand data from leads they can reach, rather than capturing true demand from those actively seeking a new solution.

The difference between capturing demand and manufacturing demand data is subtle but extremely important.

Without an engaged 1st-party audience, many lead providers rely on 3rd-party intent signals and make assumptions about different data points to meet lead qualification criteria as quickly as possible.

For example: Providers may solicit a survey to their contact database that includes the question, “Are you planning to increase, maintain, or reduce your spend on CRM solutions this year?”

Respondents who state they will increase their spend may be qualified as in-market accounts who are showing demand for CRM products. In reality, many of these respondents are simply planning to purchase additional CRM licenses from their current provider and have no intention of evaluating a new product. This is a simple example of manufacturing demand data rather than capturing true in-market demand.

And as you might expect, these leads tend to convert to new sales opportunities at a much lower rate.

3. Partners who focus on revenue outcomes vs. lead fulfillment

✅ Strategic partners who focus on revenue outcomes

In the golden age of content syndication, it was common for lead generation providers to offer guidance and transparency before, during, and after their campaigns to ensure their programs aligned with their customers’ pipeline and revenue goals. This type of collaboration came in many forms, including:

- Clear lead qualification and targeting definitions

- Full transparency into how and where content would be syndicated

- Ability to subscribe to the same newsletters and offers that audience members would be receiving

- Recommendations and feedback throughout the campaign to ensure content assets being syndicated were a strong match for the audience

- Quality checks and status reviews to ensure results were aligned with customer expectations

- Opportunities to update targeting criteria, filters, and target account lists to drive optimal results

- Flexibility to replace leads or extend campaigns to meet agreed-upon results

Some lead generation companies continue to work this way today, acting as a true extension to their customers’ marketing teams with a focus on generating the best possible pipeline and revenue outcomes. However, in today’s market, this approach seems to be the exception rather than the rule.

❌ Transactional providers who focus on lead fulfillment

Many B2B lead generation companies, especially those using aggregated lists and demand data manufacturing tactics, now operate transactionally, exchanging campaign funds for lead data, rather than genuine value across all stakeholders.

Their customers often struggle to access the newsletters, media sites, or communities the providers claim to use to engage their target audiences while receiving vague descriptions of intent signals and account qualifications. Campaigns run with minimal collaboration or opportunities for adjustments or testing, and poor lead quality is addressed by replacing leads with alternate lists of individuals who match their ICP (but may not have engaged in their campaign or explicitly opted-in). Yikes! ?

How to determine if a lead generation partner is right for you

After reading this, you may feel like we’re doomed to live in a transactional marketplace of high-volume lead data sharing at the lowest possible cost. But fear not, there are plenty of publishers, demand generation partners, and digital agencies who remain committed to trust, transparency, value exchange, and revenue-based outcomes.

Keep reading for tips on how to select the right lead generation partners, including how to research new vendors and questions you can ask to learn about what they value and how they operate.

5 steps for vetting new lead generation providers

Step 1: Find out if they own their audience

The first thing you’ll want to learn is whether or not a lead gen provider has built their own 1st-party audience and how legitimate that audience is. You can often tell by reviewing content on their website and in their marketing materials.

If they specifically reference their owned audience and which media channels they operate, hop on over to those sites to determine their legitimacy. Use a free online tool like Ahrefs or Similar Web to check out their websites and find out how much traffic they receive. Look for information on where that traffic is coming from to ensure their audiences are within the regions you are targeting.

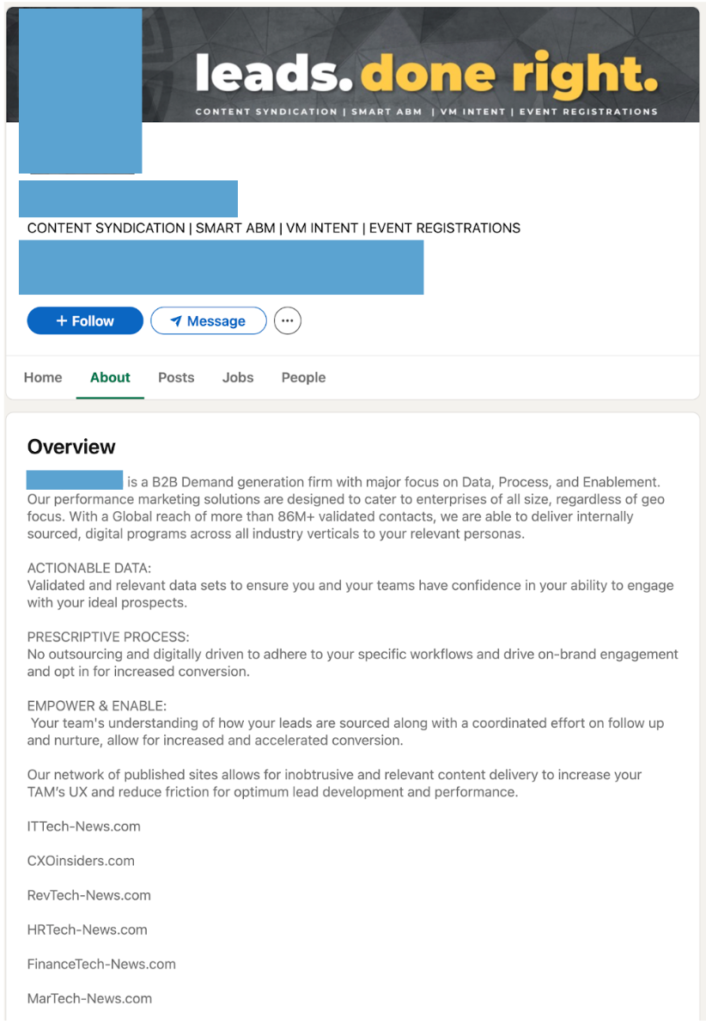

For example: A content syndication vendor like the one below sounds great from their marketing copy! They’re clearly a reputable publisher with several owned and operated media sites. Right?

However, if you do the research above on their different media sites, you’ll note that each domain they operate has minimal monthly traffic, and nearly all of that traffic is coming from desktop computers in India.

Though they represent themselves as a reputable publisher with a large 1st-party audience, they’re really a database marketing company using clever web domains to give marketers the perception that they own valuable audiences. Lead buyer beware! ?

If a lead gen provider doesn’t talk about their owned audience at all in their marketing materials, they’re likely leveraging email lists, contact databases, or 3rd-party channels for their promotions. This is another red flag.

Step 2: Take a look at where they invest

Next, research the company itself, the makeup of its employees, and where they choose to invest their resources. While not a perfect science, it can help determine whether a provider is a trusted publisher, a lead manufacturing farm, or a new entrant with a limited track record.

For example: A lead generation company with 30 employees and 60% of them in Sales will operate very differently from one with 300 employees and the majority of them in Editorial, Technology, and Customer Success roles.

LinkedIn is a great source for this type of information. If you have access to a LinkedIn Premium account, use the Insights tab to see a breakdown of employees by team and role type. Review their executive team to get a sense of their backgrounds as well as their tenure with the organization, and take a look at their headcount growth trends to see where they are currently investing or divesting. If you find that the company has reduced its number of Technology or Editorial staff by a high percentage while significantly increasing its Sales or Business Development headcount, that may be a red flag.

If the provider touts a newsletter as a distribution channel for your content, sign up to see the audience experience first-hand!

For example: A publisher like TechnologyAdvice makes it easy to sign up for a wide range of newsletters published by its various media brands, such TechRepublic, eWeek, and eSecurity Planet. Vendors can easily subscribe and follow along to see what type of information is being shared, how reputable the newsletter is, and how sponsored content is represented.

If you’re unable to find a lead generation partner’s newsletters online, that may be a red flag. Don’t be shy to ask to be added to their newsletter or email list. Follow along to see what type of content they’re sharing and how other vendor brands are represented, and keep an eye out for anything that might put your brand safety or reputation at risk. If they’re unwilling to add you to their newsletter or email list, proceed with caution.

If you choose to run an initial program with a vendor, secret shop your content, promotions, and landing page to understand the exact experience your future leads will be having. Any trustworthy lead generation provider should be more than happy to add you to their lists, send you to their landing pages, and give you full transparency into the audience experience.

Do not accept “example” landing pages. Demand the URL of the actual landing page for your content and fill out that form. If a potential partner refuses to do so or will only show you screenshots from other campaigns they have run, this is a serious red flag that warrants additional follow-up questions on how leads are being generated.

Step 5: Ask for customer referrals and discuss revenue impact

Asking new vendors for past client referrals is always a good idea. But in this market, you’ll want to make sure the reference customers are relatable to your business and can speak to real pipeline impact.

Start by asking the lead generation provider for a list of reference customers who target the same audience as you. If you’re trying to target cybersecurity professionals, it’s not very helpful to hear from a past client who was targeting marketing managers.

Next, ask those reference clients about the outcomes that are important to you, not just the outcomes the lead generation provider cares about.

For example: If your goal is to generate more meetings or pipeline, don’t just ask about lead volume and how well they matched your ICP. Dig into how well those leads converted into opportunities. If they offer vague answers like “really well” but aren’t able to provide concrete details, this could be another red flag. Reputable content syndication and lead generation companies should be able to offer reference customers who can speak to how their programs drove real pipeline and revenue results.

Questions to ask before hiring a lead generation company

In addition to doing your own research, we’ve put together a free checklist you can use to learn more about the approach, capabilities, and values of a potential content syndication or lead generation partner. Ask these questions of any lead generation provider you’re considering.