Job markets were turned upside down when the global COVID pandemic struck in 2020. Employees in industries that suffered heavily from closures and restrictions looked for employment in more stable fields. Remote work meant office workers were no longer tied to jobs in their geographic region, as suddenly entire nations became job markets.

Nearly 50 million employees switched jobs in 2021, and even in early 2022, 44 percent of employees were actively seeking other employment. But now, we’re seeing an increase in layoffs in the tech space as businesses react to the market downturn.

As a result of these rapid changes, businesses are facing significant challenges in recruiting and retaining employees along with making more informed decisions related to their workforce. Unsurprisingly, software applications that help with the hiring process, performance management, and increasing employee engagement are seen as part of the solution.

Before the Great Resignation, recruiting and retaining employees was seen largely as an HR function. Today, top-level executives see the need to attract, retain and replace employees as a matter of business survival.

HR Tech Buyers Have Expanded

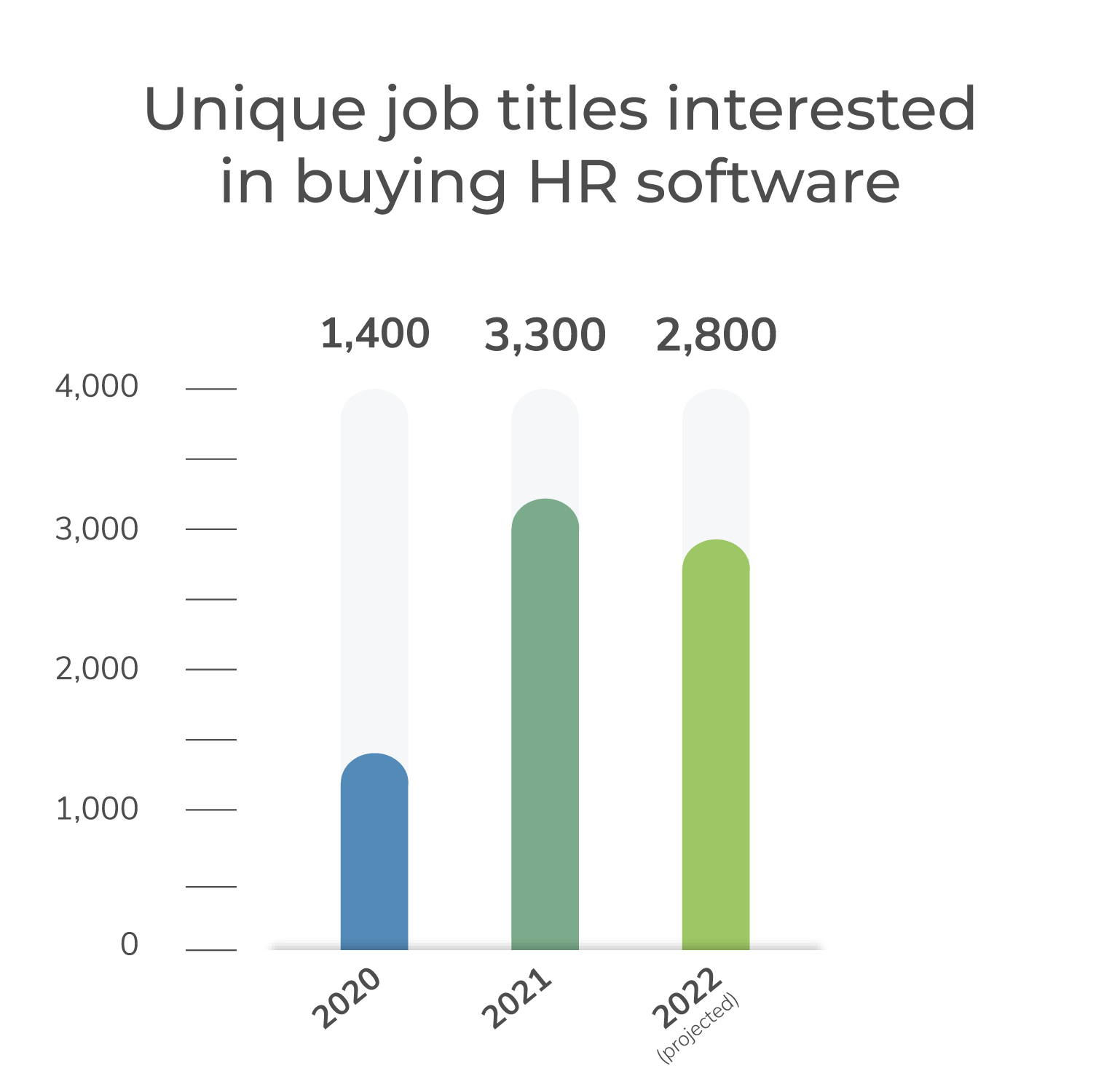

In 2020, there were about 1,400 unique job titles researching HR software, according to TechnologyAdvice first-party data. In 2021, that number exploded to 3,300, and 2022 is on pace to nearly double the 2020 number. This means that marketers need to create content that speaks to a number of roles beyond what they’ve traditionally targeted for HR tech. Additionally, they need to understand and address the concerns these new buyers are bringing to the table.

The buying committee is also larger—not just for HR tech, but for technology as a whole. The average tech purchase involves between 14 and 23 people. And these buying committees are engaged in the research process and actively comparing vendors. According to TechnologyAdvice data, 70% of buyers engaged more than once with content from one or more vendors.

And while buying committees are getting bigger and there are more unique job titles looking for HR tech, the first-party data from TechnologyAdvice found managers and director-level roles are still the best represented. These are the people you should be building content for because they’re the ones doing the product research—not executives.

Learn How Your Target Market Changes When Everyone is a Tech Buyer.

HR Needs Are Changing

What people want from their HR technology is changing, and we can see this reflected in the types of assets tech buyers are downloading and engaging with. According to TechnologyAdvice data, in 2020, a lot of people were looking for information about transforming HR, the future of HR, and cloud HR solutions. The COVID-19 pandemic had just started, and people wanted to know how they could keep their businesses operational while following state and local regulations.

In 2021, those needs shifted to building HR systems, adapting HR to the remote workforce, and best digital practices for HR. The Great Resignation changed the way employees thought about work, and organizations had to adapt and find solutions for employee turnover and engagement.

Based on an IEEE Global Study, in 2022, the biggest focuses for HR technology buyers will be on artificial intelligence and machine learning (21%), cloud computing (20%), and 5G capabilities (17%). As the economy shifts and we’re seeing more layoffs, businesses want better insights into their HR data, which they can get from AI, ML, and connected cloud applications.

HR Software Buyers Are Facing Complexity

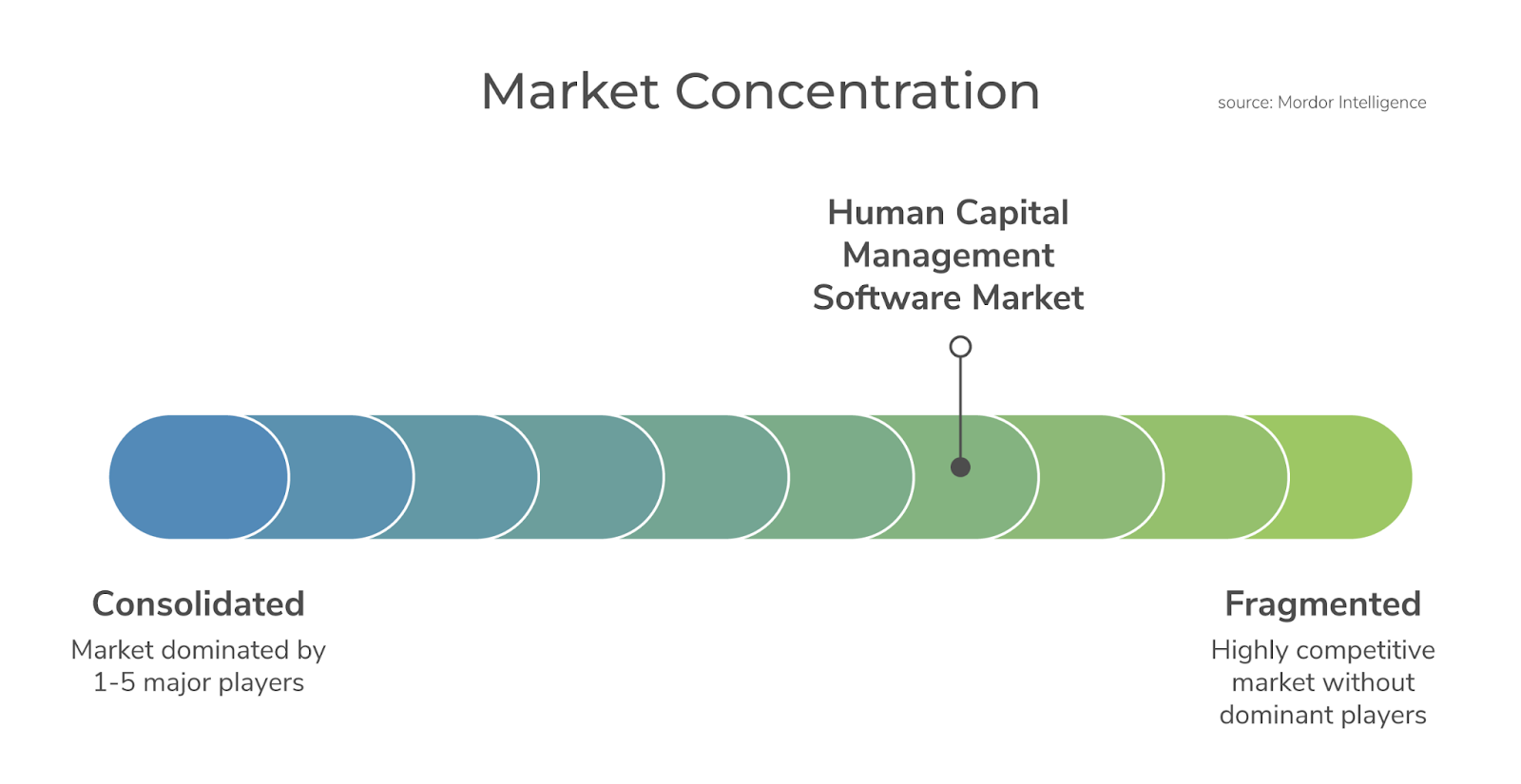

The HR software market is extremely fragmented and doesn’t have many dominant vendors. There are nearly 600 vendors to choose from, but many of those don’t overlap in their offerings. Consider that the HR software space includes payroll, applicant tracking, performance management, and many other types of software. And because of this, many organizations, especially small businesses, opt for standalone, best-of-breed products instead of full HR suites.

Due to this complexity, buyers don’t feel like they can get the information they need from a single vendor’s website. They want to be able to compare this large number of vendors in one place and do so without added bias. Therefore, buyers may not communicate with a vendor until they’re in the final stages of the buying process.

HR Tech Buyers Don’t Start Their Journeys with Vendors

In general, tech buyers complete about 70% of their buying journeys without speaking to a vendor, and this holds true for HR tech purchases. Instead, they’re getting information from third-party resources to narrow down their options. Marketers have to find trusted third-party sites to help them meet potential buyers where they’re engaging with content. If you’re only connecting with the people that come to you, you’ll miss out on a huge potential audience.

TechnologyAdvice can help you get in front of these buyers. We’ve earned the trust of 100 million technology buyers who come to our portfolio of websites each year to navigate the tricky tech buying process. Supporting our portfolio is a team of 150+ editorial experts or technologists covering more than 200 tech-related topics and publishing around 5,000 pieces of content each year.

To learn more about reaching buyers early in their buying journey, check out TechnologyAdvice’s lead generation and content syndication programs. We can help you meet buyers in each stage of the buying journey and create the content you need to capture their interest.